Overview

- This guide will cover how to reconcile Shopify transactions with the bank feed in QuickBooks Online for those using the Shopify + QuickBooks Online integration.

- Match the Shopify payout to the synced bank transfer transaction.

- Allocate other payment types to the clearing accounts.

Reconciling Shopify Payments payout

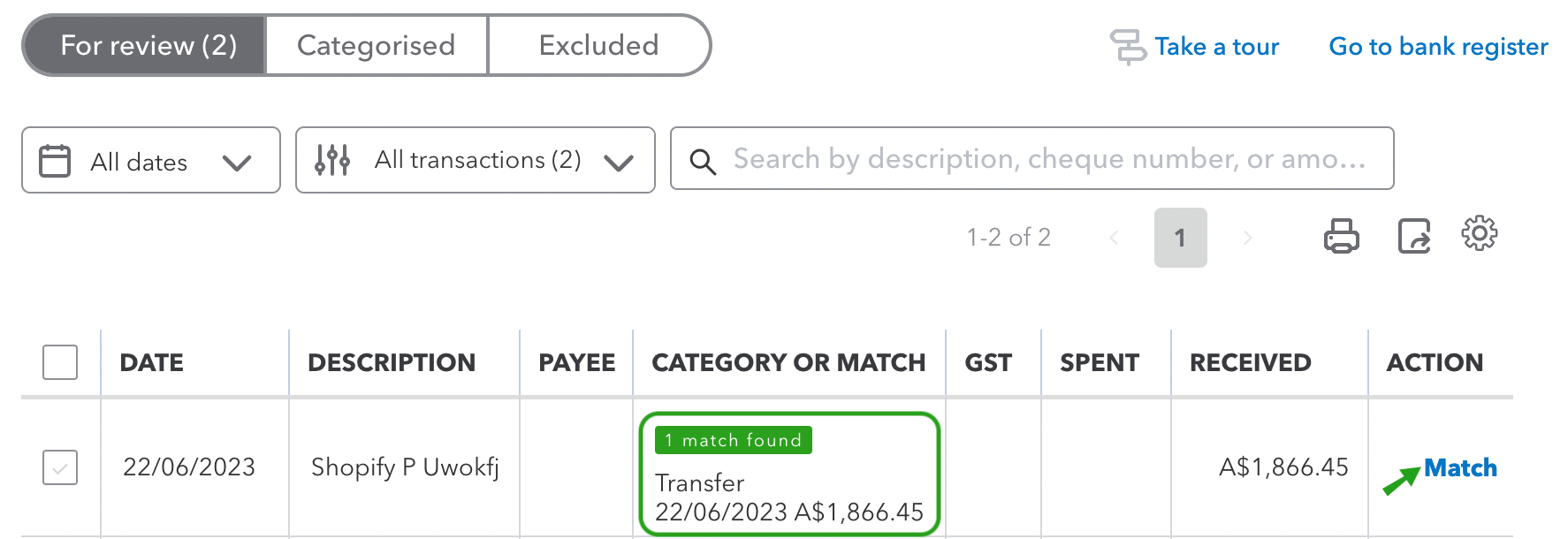

The Shopify payout is automatically matched to a bank transfer transaction that was synced by the integration. All you need to do is confirm that the match is correct to complete the bank reconciliation process for these transactions.

-

Log in to QuickBooks Online.

-

Go to Banking and select the bank account where Shopify payouts are deposited.

-

Find the Shopify payout with an automatically matched transfer.

-

Click Match to confirm that paired bank transfer.

Reconciling other payment deposits

For other payment types, you need to take note of what clearing account each payment type has been mapped to. Then, you’ll need to go through the following steps for each payment type to complete the bank reconciliation process. To view the clearing accounts mapped to the payment types, follow this guide on accounts mapping.

For example, you’ve recorded a cash payment into Shopify. The integration syncs this to the clearing account assigned to the cash payment type. When you deposit the cash to your bank account, you must allocate this to the same clearing account mapped to the cash payment type, e.g. Shopify Cash Clearing. Follow these steps for the cash payment type:

Let us reconcile your books!

Our Integration Specialists can also take care of reconciling your books.

-

Log in to QuickBooks Online.

-

Go to Banking and select the bank account where cash is deposited.

-

Click the cash deposit related to Shopify. You can follow the sample details below:

Payee – Shopify Cash

Category – “Shopify Cash Clearing” or the mapped clearing account if you changed the default mapping.

Tax – This should be 0% (e.g. Out of Scope or Tax Exempt) since the tax amounts have already been recorded into the synced invoice.

-

Click Add.

What is a clearing account?

Clearing accounts are temporary accounts that hold a record of payment received as per POS/eCommerce app before the money is deposited by the payment service into your bank account. This means your sales and payments data are always up-to-date. Allocating the actual deposits to the clearing accounts will offset the amount on the clearing account that has the temporary balance and post it to a permanent account.

Shopify accounting eBook

Learn how to automate your Shopify accounting and spend less than an hour on your books every month.