How to account for WooCommerce sales taxes: Accounting guide

Whether you’re a newcomer or a seasoned entrepreneur, managing international sales taxes and adhering to legal requirements can be a challenge for any WooCommerce business. By gaining a comprehensive understanding of these tax obligations, you can ensure your accounting is accurate and compliant.

This guide will delve into sales tax such as GST and VAT, steps for setting up sales taxes in WooCommerce, accounting for sales tax in your accounting software, the significance of providing tax receipts, regularly reviewing tax reports, and determining if a tax accountant is necessary for your business.

What is sales tax? What is VAT and GST?

Sales tax is a tax that is imposed on the sale of goods and services. It is generally calculated as a flat rate or percentage of the total purchase price. The amount of sales tax can vary depending on the location of the business, the location of the customer, and other factors. Though it’s great to have a foundational understanding, don’t let the next few paragraphs scare you! Fortunately, WooCommerce can automatically calculate how much tax to charge.

In the US, sales tax is paid by the consumer at the point of purchase, and then from the vendor to the government. However, jurisdictions at the local and state levels can all enforce their own regulations. If you’re in the US, you only have to register for tax in the state where you have a physical presence. Rules for customers outside of your region can differ based on whether or not you have suppliers there.

Outside of the US, sales taxes have other names such as value-added tax (VAT) in the EU/UK or goods and services tax (GST) in Australia/New Zealand. For those located in the EU, you’ll have to charge EU customers VAT on every sale. The rate is determined by distance selling thresholds. WooCommerce businesses in Australia and New Zealand will need to charge a flat rate of 10% or 15% respectively to customers in the same region.

Many WooCommerce stores will be selling to customers outside of their home country. In these cases, you typically don’t have to register for tax until you meet certain thresholds. For example, in the US, there’s an annual threshold of 200 transactions or US $100,000. There are similar international sales tax thresholds for Australia, New Zealand, the EU, the UK and across Asia.

How to set up automated taxes in WooCommerce

Clearly, there are an endless number of amounts you could be charging customers for sale tax depending on your location as well as theirs. As we mentioned earlier, WooCommerce can do all the calculations for you. To get started, go to Settings > Tax and make sure the ‘Enable taxes and tax calculations’ box is ticked.

Do I need to pay for an automated tax plugin for WooCommerce?

If you’re using WooCommerce’s default tax tool, there are some potential downsides. The prices on your site won’t include tax, meaning customers won’t see how much tax they have to pay until they enter their shipping address. On top of this, you won’t be able to override any tax rates (this might be relevant to you if you’re in the US and have a tax nexus).

To avoid the disadvantages, an automated tax plugin for WooCommerce could be beneficial. These can display prices with the appropriate tax included and/or create tax rate exceptions. However, you’ll have to pay an upfront fee or at least $20/month to leverage these tools. Popular examples include TaxJar, Quaderno and Avalara AvaTax.

How to account for sales tax in accounting software

Now that you’re charging the right amount of tax for each customer, how do you actually account for this in your general ledger? Rather than manually entering each order and the sales tax paid, you can use an accounting integration to automate the entire process. Amaka offers integrations for WooCommerce to Xero, WooCommerce to QuickBooks Online (QBO) and WooCommerce to MYOB.

What are the benefits of a WooCommerce accounting integration?

- Sync your WooCommerce transactions with your accounting software through free or premium plans

- Option to either create a separate invoice for each order or compile daily orders into a summarized invoice

- Customize your sales summary view with a variety of formats to choose from

- Include all payment transactions, taxes and fees such as gift cards, tips, sales taxes, and payment fees

- Transactions are automatically matched to your bank feed for lightning-fast bank reconciliation

How do I set up a WooCommerce accounting integration?

If you want assistance for setting up your WooCommerce accounting integration, you can book a free 30-minute support session and we can set it up for you! Otherwise, have a crack at it on your own. You can set up the integration in 2-minutes with default settings or spend time to customize advanced settings. Follow the relevant setup guide:

- How to connect WooCommerce to Xero

- How to connect WooCommerce to QBO

- How to connect WooCommerce to MYOB

Woocommerce accounting eBook

Learn how to automate your Woocommerce accounting and spend less than an hour on your books every month.

Issuing tax receipts to customers

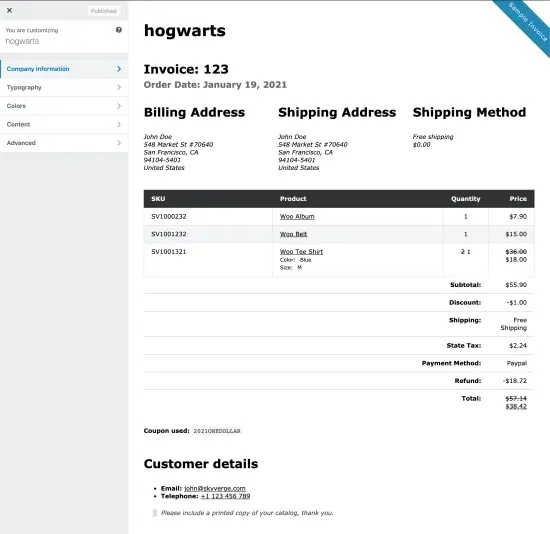

Like with sales taxes, WooCommerce has its own default tax receipt that it will send to customers. It sends this as an email with key information such as the order number, order date, products, prices and billing information. For most WooCommerce businesses, this is adequate.

Do I need to pay for a tax receipt plugin for WooCommerce?

In some scenarios, you could benefit from paying for a dedicated tax receipt plugin or a combined automated tax and tax receipt plugin. For example, if you need invoices sent as a PDF, you could use a plugin such as Flexible Invoices. Another scenario would be needing to include more detailed tax receipt information such as for B2B. In this case, Quarderno is a combined automated tax and tax receipt plugin that would fulfill these needs.

Reviewing your tax reports every quarter

Often, people view tax compliance as a once-a-year task. However, getting into the habit of reviewing your tax reports every quarter can help you avoid costly mistakes. With a WooCommerce accounting integration set up, sales taxes on each transaction will be automatically recorded in your accounting software. You can compare these to the reports from WooCommerce, and review monthly tax amounts.

To access your WooCommerce tax reports, log into your dashboard and navigate to the Reports tab. From there, click on Taxes > Taxes by Date > Year. You’ll then be able to review that your tax amounts for each month are accurate and even break these down by tax codes based on customer location.

Do you need to hire a tax accountant?

Knowing when to hire a bookkeeper or accountant for your e-commerce business can be confusing. While some business owners may feel confident in handling these responsibilities themselves, others may find it beneficial to seek out assistance. Typically, WooCommerce businesses of any size will benefit from having a tax accountant.

Whereas bookkeeping is more straightforward, tax accounting, particularly if you’re selling in multiple countries, is more complicated. A tax accountant experienced in e-commerce can make a significant return on investment for your business. On top of dealing with tax returns, they can identify opportunities for deductions and provide advice based on tax implications.

Key takeaways on WooCommerce sales taxes accounting

With a clear understanding of the various tax requirements and the tools and strategies outlined in this guide, you can be confident in managing your WooCommerce sales taxes and ensuring compliance with the law. Whether you choose to tackle it all on your own or get help from a professional, being proactive and informed is key.

Woocommerce accounting eBook

Learn how to automate your Woocommerce accounting and spend less than an hour on your books every month.