Payment methods every Shopify seller needs to offer: PayPal, Afterpay, Klarna, Adyen, and more

The best payment methods for Shopify sellers to offer customers will vary depending on your unique business. However, there are different categories that you would benefit from considering. In this article, we’ll go through exactly what a payment gateway is, why offering multiple choices is crucial, and how to choose the right ones for your e-commerce store.

Payment gateway vs. payment method

A payment gateway is a piece of technology that processes online payments by encrypting and transmitting the sensitive data between a customer’s browser and a store’s website. A payment gateway will send the transaction to a payment processor or bank, such as Visa or Mastercard, for authorization. If approved, it will move the funds into a merchant’s account.

A payment method is the specific way a customer pays. For example, cash, credit cards, Google Pay or BNPL. To offer a range of payment methods, your Shopify store will need to have different payment gateways installed.

Why offering multiple payment methods is crucial for Shopify sellers

Giving customers a range of payment methods is crucial to boost your Shopify’s store’s conversion rates and credibility. By providing options like credit cards, digital wallets and BNPL (buy now, pay later), including trusted names such as PayPal and Afterpay, customers are more likely to have access to their preferred option. Hence, you can reduce cart abandonment and improve trust.

Additionally, you can improve the shopping experience for your customers. For example, mobile-friendly payment methods like Apple Pay and Google Pay significantly reduce friction while still maintaining security.

Shopify Payments for credit cards, digital wallets and Shop Pay

To start, Shopify Payments is Shopify’s native payment gateway and is powered by Stripe. It allows you to process transactions for your store online and in-person. It allows you to accept credit cards, digital wallets such as Apple Pay and Google Pay, and Shop Pay. Additionally, you can take payments through Facebook, Instagram and Google.

Being able to accept Apple Pay and Google Pay is a key benefit of using Shopify Payments. In a recent report on the most used payment methods in e-commerce, mobile wallets made up almost half of all payment transactions worldwide. This is expected to increase to over 60% in the next few years.

Cost of Shopify Payments: Between 2.9% and 2.4% (depending on what plan you’re on), plus $0.30 per transaction.

Shopify accounting eBook

Learn how to automate your Shopify accounting and spend less than an hour on your books every month.

Offer PayPal to build trust in your Shopify store

Next, PayPal has become a household name, known to be reliable and trustworthy. There are programs to prevent fraud to protect both the seller and the buyer. Hence, it can help potential customers feel safer making a purchase with your store. PayPal allows customers to use the money in their account or a credit card to make purchases.

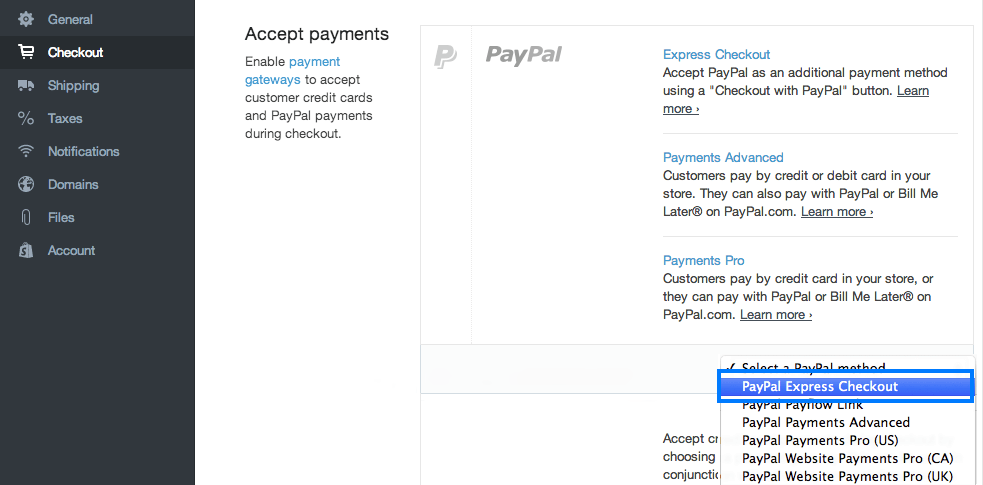

PayPal can be integrated directly into Shopify from your Shopify dashboard. In fact, you automatically get a PayPal Express Checkout account when you create a Shopify store. Simply go to Settings > Payments > Additional payment methods. From there, you’ll be able to follow the wizard to complete the setup.

Cost of PayPal: 3.49%, plus $0.49 of the transaction. International payments incur an additional 1.5%.

BNPL: Adding Afterpay and Klarna to Shopify

Next up, BNPL options such as Afterpay and Klarna are essential payment methods to include on your Shopify store. These integrate directly with Shopify to allow customers to pay for a purchase in four installments. BNPL can help you attract more customers while potentially increasing your average order value. Both Afterpay and Klarna will pay you as the merchant in full at the time of sale.

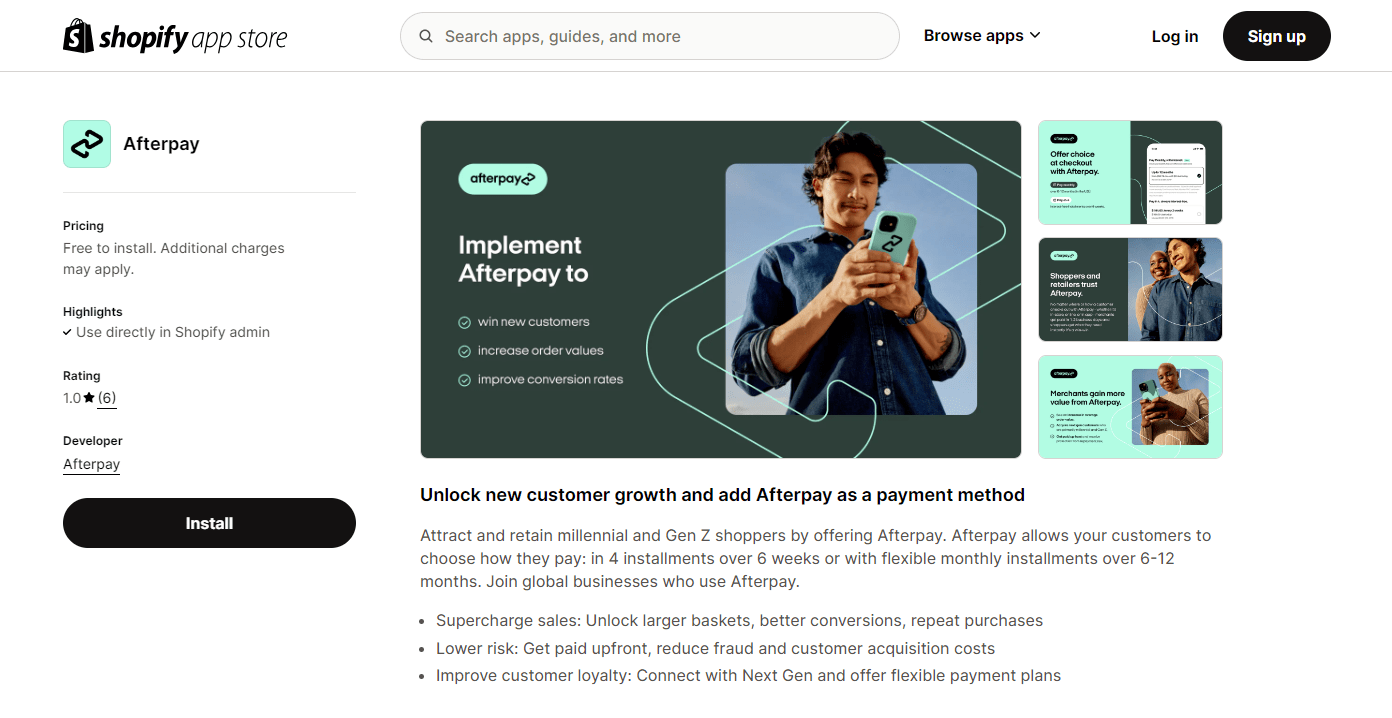

To add Afterpay to your Shopify store, install the app from the Afterpay page on the Shopify App Store. From there, grant Afterpay the relevant permissions, connect your accounts and follow the wizard to complete the setup.

Cost of Afterpay: Between 4% and 6% of the sale, plus a fixed fee per transaction (varies depending on your region and sales volume).

To add Klarna to Shopify, the process starts at the Klarna Merchant portal. You need to be a Shopify admin to configure this payment method properly. Go to Integration guides > Shopify > Continue > Install Klarna Shopify Application > Generate and connect credentials. You’ll need to download the API credentials even though you won’t need to use these files. Then Continue > Verify integration. Now, you’ll be able to find and activate Klarna in your Shopify dashboard.

Cost of Klarna: Between 3% and 6% of the sale. Additional fees and service charges vary.

Catering to international markets: Adyen, Mollie, Alipay, WeChat Pay and more

Finally, it’s important to consider that payment methods customers in your target regions would expect to see. For instance, Adyen and Mollie are payment gateways that support a larger variety of payment methods popular in Europe. Another example is making sure you offer Alipay and WeChat Pay if you’re hoping to have a presence in China.

How to automate your Shopify accounting processes

With a Shopify accounting integration by Amaka, you can automate manual data entry and bank reconciliation. We offer Shopify + Xero, Shopify + QuickBooks Online, Shopify + MYOB and Shopify + Sage. The integration will automatically sync sales and payments on a daily basis to ensure your financial data is always accurate.

The next best part of Amaka’s integrations is the fast-tracked reconciliation. Transactions are automatically matched to the bank feed. This means, all you have to do is click OK to confirm rather than manually going through each transaction. Any discrepancies are highlighted so that you can investigate further.

If you want to outsource the reconciliation process entirely, including figuring out why discrepancies are occurring and fixing the issue, you can explore Amaka’s Managed Reconciliation Service. With this, we will reconcile all transactions synced by one of our integrations and send you regular updates.

Key takeaways on payment methods for Shopify sellers

Ultimately, beyond the three key payment methods, Shopify sellers need to consider including BNPL options and payment gateways that are specific to the regions you’re prioritizing. After you’ve set these up, implementing an accounting integration from Amaka can help to automate the manual data entry and reconciliation process.