Shopify GST: How to set up taxes, Shopify fees and more for Australia

Shopify businesses in Australia will have heard of the goods and services tax, otherwise known as GST. Despite it being a flat fee, it’s not always as simple as it sounds. In this comprehensive guide, we’ll go through everything you need to know about GST for Shopify sellers.

First and foremost, we run through exactly what GST is, when you need to register for it and when you need to charge customers GST. Then, we’ll deep dive into how to configure your Shopify GST settings. Finally, we’ll cover common questions surrounding Shopify fees and automating your accounting.

What is GST and when do I need to register for it?

GST or goods and services tax is the sales tax charged on most goods and services in Australia. When charged, it is a flat rate of 10%. Understanding GST is essential to staying compliant and effectively managing your finances.

According to the Australian Taxation Office (ATO), you don’t need to register your Shopify business for GST until you exceed the threshold of $75,000 in annual turnover to Australian customers. If you aren’t registered for GST, you do not charge customers GST.

Once you surpass $75,000 of annual sales to Australians, you must then register for GST with your Australian Business Number (ABN). After this, you will need to charge 10% GST to your customers. You will need to start completing and reporting a quarterly Business Activity Statement (BAS) to the ATO as well.

Shopify accounting eBook

Learn how to automate your Shopify accounting and spend less than an hour on your books every month.

Do I need to charge GST when selling outside of Australia?

If you’re an Australian business selling to customers internationally and are not registered for GST, you do not need to charge GST to any customer.

If you’re an Australian business selling to customers internationally and are registered for GST, exported goods are generally GST-free, according to the ATO. This applies when your business exports the goods from Australia within 60 days of issuing an invoice or receiving payment (whichever occurs first). If the goods remain in Australia for 60 days or longer, you need to charge 10% GST to your customer.

For example, you run a GST-registered Shopify business selling dog toys to customers in Australia as well as across borders. Any sales to international customers are GST-free since they are all sent within 60 days of payment. However, you must collect 10% GST on all sales to Australian customers and pay it to the ATO.

What GST exemptions are there?

There are some items that you don’t need to charge GST on in Australia. These are considered GST-free sales and include basic food, medical products, some educational products and some charitable activities. Note that digital goods are taxed as normal in Australia.

Shopify GST settings: How to configure your tax settings

To set up Australian GST in your Shopify settings:

- Go to the relevant store and then Settings > Taxes. Check to make sure that Australia is in the list of countries. Otherwise, you will need to add it as a shipping zone.

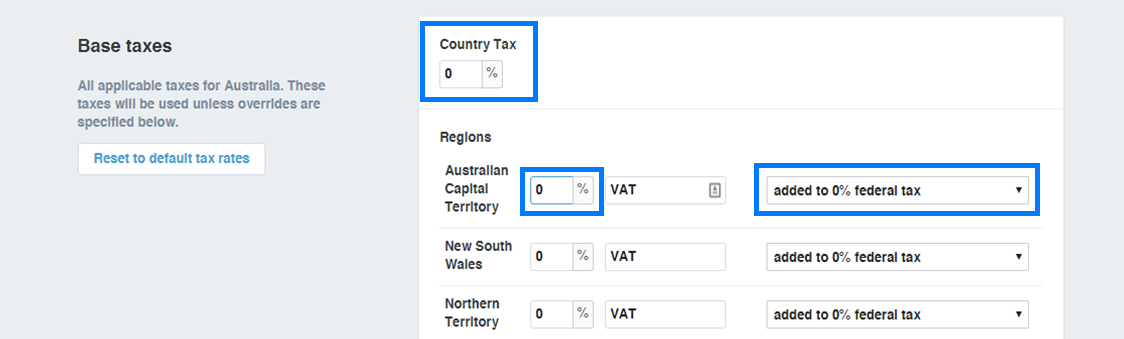

- Click Australia and add 10 in the Country Tax field at the top.

- Within the Regions section, leave the % as 0 and select added to 10% federal tax from the dropdown for each state and territory.

To set up any GST-free sales or other tax overrides in Shopify:

- Go to the relevant store and then Settings > Taxes. Check to make sure that Australia is in the list of countries. Otherwise, you will need to add it as a shipping zone.

- Click Australia and find the Tax overrides section.

- Select the collection from your store that you want to override the tax rate on and enter 0 in the Tax Rate field.

Do you need to pay GST on Shopify fees?

According to the ATO and Shopify, the standard 10% GST rate is charged on all transactions processed through Shopify Payments. Transaction fees are automatically included and accounted for.

How to automatically sync GST from Shopify to your accounting software

You can easily sync your sales, taxes and payments from Shopify into your accounting software with an Amaka accounting integration. We offer Shopify + Xero, Shopify + QuickBooks Online, Shopify + MYOB and Shopify + Sage on both free and paid plans depending on how many transactions you make per month.

Using an accounting integration allows you to have accurate and timely data on a daily basis. We sync all relevant information including GST, other sales taxes, fees, gift cards, tips, shipping, discounts, refunds and more. Transactions are automatically matched to your bank feed to speed up the reconciling process. Schedule a walkthrough to learn more.

Otherwise, you can start the setup process on your own by following our step-by-step guides:

- How to connect Shopify to Xero

- How to connect Shopify to QuickBooks Online (QBO)

- How to connect Shopify to MYOB

- How to connect Shopify to Sage

Do I need a tax accountant?

We typically recommend all e-commerce businesses engage with a tax accountant as soon as they need to (or want to) register for GST. Amaka has an Advisor Directory with accounting professionals who specialize in e-commerce. You can filter it down to those in your location and those with experience in Shopify.

Key takeaways on Shopify GST in Australia

Ultimately, navigating GST can be a daunting task for any Shopify seller in Australia. It’s important to understand when GST applies and how to set up your tax settings properly in your Shopify dashboard. However, once you get set up with the right tools and professional help, you can save time and automate your tax processes.