Ultimate comparison: Best Shopify to QuickBooks Online integrations

For Shopify merchants using QuickBooks Online to manage their accounting, finding the right integration to connect these platforms is vital. With several accounting integration options available, choosing the best one can be daunting. In this guide, we’ll compare some of the top solutions on the market.

First, see the features that you can expect from all leading Shopify to QuickBooks accounting integrations. Then, compare ratings, pricing, benefits and considerations for options from Amaka, A2X, Bookkeep, Intuit, Link My Books, Synder, and Webgility. At the end, you’ll be able to find a full table that summarizes these findings.

Shopify accounting eBook

Learn how to automate your Shopify accounting and spend less than an hour on your books every month.

What features can you find in all Shopify to QuickBooks integration apps?

Before we dive into the differences between the leading Shopify to QuickBooks Online accounting integrations, let’s go through some of the key features you can expect to find in all of them. Here’s a quick summary:

- Automatically sync sales, fees and taxes

- Backsync historical financial data

- Automatic matching to the bank feed for fast-tracked reconciliation

- Offer QuickBooks integrations for a variety of sales channels to allow multi-channel selling

Sync transactions from Shopify to QuickBooks Online

First and foremost, any quality integration should sync sales, fees and taxes from Shopify. However, you’ll find that some will sync sales as an invoice whereas others will sync a journal entry. There can be one per order, per day or even per Shopify payout. Ideally, you’d be able to choose between different options.

Backsync data from previous months

On a similar note, you should be able to backsync historical data to catch up on your books. However, this often depends on the plan you choose. Some solutions will actually charge you an additional fee to do a backsync.

Automated bank reconciliation process

Next, the invoice or journal entry should be automatically matched to the Shopify payout deposited in your back account. This removes the need to manually match each transaction and speeds up the reconciliation process. In order for it to match, the integration needs to ensure fees are accounted for appropriately since the payout amount will have fees subtracted.

Has QuickBooks Online accounting integrations for other platforms

Finally, a strong integration solution will allow multi-channel businesses to seamlessly integrate all their sales channels into QuickBooks Online. This may include other e-commerce platforms, POS systems and marketplace platforms. For example, Amaka allows you to connect platforms like Shopify POS, Square, WooCommerce and eBay to QuickBooks Online as well.

Full breakdown of leading solutions

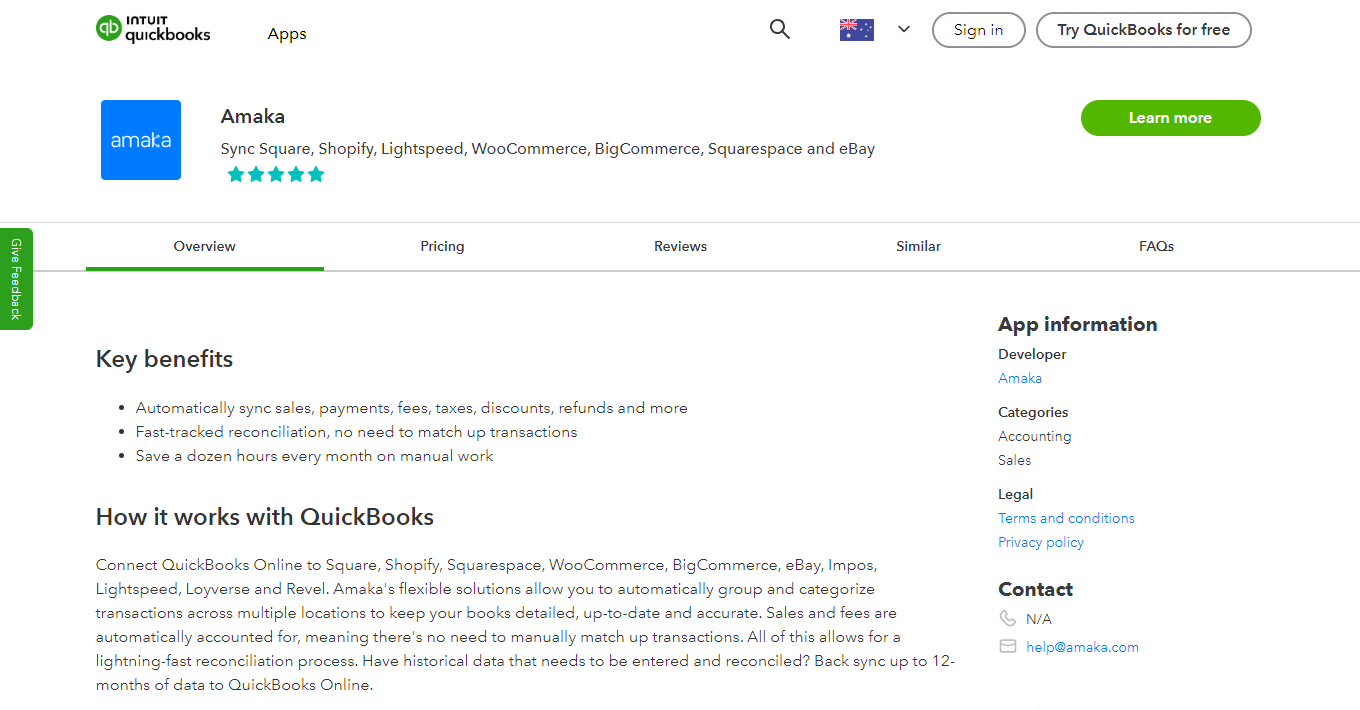

Amaka

QuickBooks App Store rating: 5 ★

Pricing:

Free plan available

Premium plan starts at $18/month (7-day free trial)

Benefits and considerations:

Amaka’s Shopify + QuickBooks Online integration gives you the choice to sync Shopify transactions as a daily summarized invoice or with an invoice per order. This will include sales, payments, fees, COGS, refunds, shipping details, gift cards, and more from both Shopify and Shopify POS.

To ensure your data is up-to-date and accurate, even before the Shopify payout hits your bank account, the integration uses a clearing account to temporarily show sales. After you receive the payout, invoices are automatically matched to the Shopify payout in the bank feed for sped-up reconciliation.

You have full control over your account mapping for sales and payment methods. Additionally, you can choose how your invoice looks and whether it’s broken down by product, category or location.

A consideration to make is that Amaka’s integrations do not sync customer details and stock levels.

Amaka is trusted by over 80,000 small businesses and accounting professionals, and has over 1,350 5-star reviews across different platforms. We’re known for our seamless integrations and unlimited, ongoing support. You can reach our QuickBooks-certified, CPA-trained Integration Specialists through help desk and video call around-the-clock.

A2X

QuickBooks App Store rating: 4.7 ★

Pricing:

Starts at $29/month (Free trial available)

Benefits and considerations:

The A2X for Shopify integration allows you to sync sales and fees to a journal entry in QuickBooks Online for each Shopify payout. See a summary of revenue, fees, taxes and returns. These are then matched to the bank feed for faster reconciliation.

In terms of customisation, you can choose whether the journal includes a breakdown of SKU, product type or country. For account and tax mapping, you can use your existing chart of accounts or create a new one.

It’s important to consider that you can only sync a summarized journal and can’t choose to have a journal for each order. Furthermore, journals are only synced once your Shopify payout hits your bank account, meaning your QuickBooks data isn’t updated daily through a clearing account.

Bookkeep

QuickBooks App Store rating: 4.5 ★

Pricing:

Starts at $45/month (14-day free trial)

Benefits and considerations:

The Bookkeep Accounting Automation app syncs daily Shopify orders into a summarized journal entry in QuickBooks Online. You’ll see information on sales, taxes and COGS. These will be matched to the deposits in your bank feed to speed up reconciliation.

Though you can customize the chart of accounts mapping, there aren’t as many other customisation options compared to other integration apps. For instance, you can’t choose to sync one entry per order and you can’t customize the journal entry breakdown. Additionally, the interface is known to be less intuitive. Bookkeep also charges a higher subscription fee.

Intuit

QuickBooks App Store rating: 4.8 ★

Pricing:

Free

Benefits and considerations:

The Shopify Connector by Intuit is the native option offered by Intuit (who owns QuickBooks). This integration syncs your sales, inventory, customer data and taxes to an invoice. There are suggested matches to the bank feed and reconciliation takes a few quick steps.

To set up the integration, you have to create individual rules. For example, what should be created when an order is made or a payout is paid. Though you can choose to sync sales as an invoice or a receipt, there aren’t many other customisation options available.

Finally, consider that you can’t choose to sync summarized invoices or receipts. Depending on the scale of your business, this can lead to an overwhelming number of entries in QuickBooks.

Link My Books

QuickBooks App Store rating: 4.9 ★

Pricing:

Starts at $17/month (14-day free trial)

Benefits and considerations:

Link My Books will sync a summarized journal entry into QuickBooks Online each time a Shopify payout is received. This includes sales information, fees and taxes. The entry will match the bank feed for faster reconciliation.

There are fewer customisation options compared to other apps, however, the options available may be enough for some businesses. Note that you cannot choose to sync an entry for each order and cannot customize the entry breakdown. Additionally, your data isn’t updated daily through a clearing account (journals are only synced after the Shopify payout is received).

Synder

QuickBooks App Store rating: 4.6 ★

Pricing:

Starts at $48/month (15-day free trial)

Benefits and considerations:

The Synder app allows you to sync Shopify sales to QuickBooks Online as a daily summarized journal entry or with an individual entry per order. The journal entry will show details on fees, taxes, shipping, discounts, customers, products and more.

Journal entries are then matched to the bank feed for easier reconciliation. There are customisation options available such as the ability to set up rules and product mapping.

Factors to consider include a higher subscription cost, limited support options and no multi-location functionality.

Webgility

QuickBooks App Store rating: 4.7 ★

Pricing:

Starts at $49/month (15-day free trial)

Benefits and considerations:

Webgility can sync Shopify data to QuickBooks Online as summarized journal entries or one entry per order. This includes sales, fees, taxes, shipping, inventory and pricing. They offer custom mapping and automated matching for less stressful reconciliation.

Consider that there are fewer customisation options in terms of grouping and journal entry breakdowns. Webgility is also known to have synchronization errors occasionally. They do offer support through chat and email, however, the support team is only available from 8am to 5pm PST. Furthermore, the subscription fee is higher than average.

Shopify to QuickBooks Online integration comparison table

|

INTEGRATION |

BENEFITS |

CONSIDERATIONS |

|

Amaka (5 ★) 100% free plan available Premium plan starts at $18/month (7-day free trial) |

|

|

|

A2X (4.7 ★) Starts at $29/month (Free trial available) |

|

|

|

Bookkeep (4.5 ★) Starts at $45/month (14-day free trial) |

|

|

|

Intuit (4.8 ★) Free |

|

|

|

Link My Books (4.9 ★) Starts at $17/month (14-day free trial) |

|

|

|

Synder (4.6 ★) Starts at $48/month (15-day free trial) |

|

|

|

Webgility (4.7 ★) Starts at $49/month (15-day free trial) |

|

|

How to integrate Shopify with QuickBooks Online

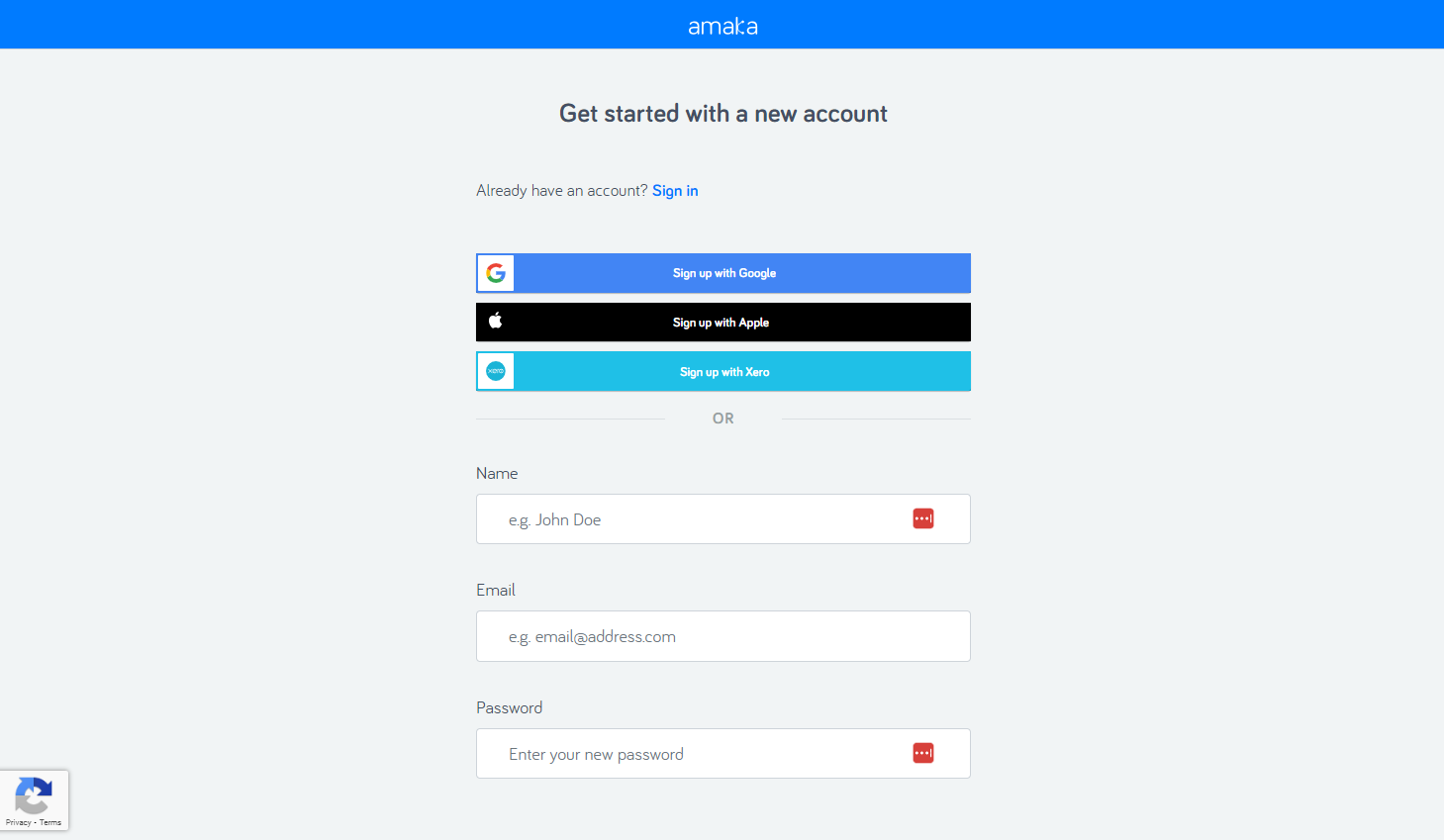

When you choose an Amaka integration, you have the option to book a guided setup with one of our Integration Specialists, or, go through the setup process on your own. If you start on your own and get stuck at any point, you can always reach out. Here are the steps to set up the Shopify to QuickBooks Online integration by Amaka.

- To start, register for an Amaka account.

- Then, click New integration and select Shopify + QuickBooks.

- Authenticate your QuickBooks Online and Shopify accounts.

- Continue to follow the wizard to choose your configuration, invoice breakdown and format, account mapping and scheduling options.

- Click Save + Continue and you’re all done!

You can rest assured that our guidance doesn’t end after you’ve finished setting up the integration. Our QuickBooks-certified, CPA-trained team are working round-the-clock to ensure you get unlimited support through the help desk and video calls. Plus, this goes for all customers, not just for those on a paid plan.

Getting professional help with your accounting integration sync

If you’re looking for additional help from an accountant or bookkeeper, we recommend reaching out to an accounting professional experienced in e-commerce and technology. They should be able to help you with choosing the right Shopify to QuickBooks integration for your business and potentially with setting it up.

For those wanting a walkthrough or help with an Amaka integration, you can book a support session or reach out via the help desk. We also offer a unique solution called the Managed Reconciliation Service. With this, we can take care of monitoring and reconciling all transactions. This includes identifying and fixing discrepancies, as well as sending regular reports.

Let us reconcile your books!

Our Integration Specialists can also take care of reconciling your books.

Key takeaways on the best Shopify to QuickBooks integration

Ultimately, choosing the best app to integrate your Shopify store and QuickBooks Online accounting software depends on your specific business needs, budget and preferences. Each solution offers unique capabilities and considerations. Whether you’re an e-commerce business or an accounting professional working with e-commerce businesses, investing in a reliable integration is essential to automating processes and driving growth.