Advantages of technology for accountants: How to increase margins

Amaka recently teamed up with Practice Ignition, Karbon and POP Business to host a webinar on how to unlock better margins and work-life balance with accounting technology. In this article, we break down the key points shared by our incredible panelists, Rebecca Mihalic, Omer Khan and Sidney Cachuela, on how accountants can leverage technology to increase margins.

The impact of accounting technology in the industry has grown rapidly over the past few years, allowing accountants to automate and systematise a variety of tasks. With the free time created, you can then use this to take on more tasks or give yourself some more free time. We’ll take you through everything from pricing models to how to implement technology for better margins.

How to choose the right accounting technology stack

Accounting technology is great but many firms end up overdoing the tech stack. Rather than chasing every shiny object that you see, it’s important to be thoughtful and figure out whether the tool you’re looking at actually solves a problem and/or saves you time. The right tech stack can help you systematise and automate a myriad of processes.

Omer Khan often helps accounting firms look at their operations from beginning to end. For example, you might want to implement something like Practice Ignition to manage the proposal, contract and client payment. Then, you can look into a workflow management platform such as Karbon to ensure the entire team can optimise their productivity.

Rebecca Mihalic explains the process she uses in her award-winning firm. She figures out exactly how long tasks take, how much that time is worth in a dollar value and the opportunity cost of the team working on a different task. From there, she can work out whether implementing a certain tech tool is worthwhile or not.

What accounting tasks can be systematised or automated?

There are a few basic accounting tech tools that every accountant can consider implementing. For example, using an accounting integration by Amaka allows you to create an automatic, daily sync from your client’s POS system or e-commerce platform to their accounting system. Transactions are synced into the correct account and reconciliation becomes lightning-fast.

Furthermore, accountants can use AI technology for better automation. For instance, Rebecca Mihalic set up alerts on KPIs that tell you when you need to contact a client rather than having to go through every client file manually. Similarly, Sidney Cachuela uses AI to take minutes during meetings so that no one has to waste mental energy on multitasking.

Omer Khan explains how having a workflow management platform gives accounting firms a centralised place to view work and collaboration tasks. His research has found that optimising workflows can improve efficiency and turnaround time by 50%, freeing up time to take on more projects. One firm he was helping was able to have a 30% improved year-on-year growth rate.

It can get difficult to balance constant availability with actually getting your work done. Rebecca Mihalic and Sidney Cachuela are both advocates for using a booking system such as Calendly. It syncs with their calendars and allows them to choose when to be available for video calls with clients. Rather than having to email back and forth, clients can book in a time on their own.

Change management for accounting technology implementation

Despite all the advantages of technology for accountants, if you haven’t implemented them correctly, you won’t be able to effectively increase your margins. Omer Khan would even say that only 20% of your success comes down to the tool itself with the remaining 80% dependent on your change management.

There needs to be an understanding of the benefits of every accounting technology tool as well as a clear implementation plan. Rebecca Mihalic has found that having a ‘champion’ for each piece of software has been useful in her firm. They’re not the only one that uses the software but they’re responsible for planning, training, updates and regular check-ins with the team.

Sidney Cachuela uses the ‘champion’ model in his accounting firm as well. He emphasises the importance of hiring the right people for a role like this. They should be versatile, adaptable and able to manage conflict. People in more managerial positions could be better at understanding how certain tools align with business objectives on a higher level.

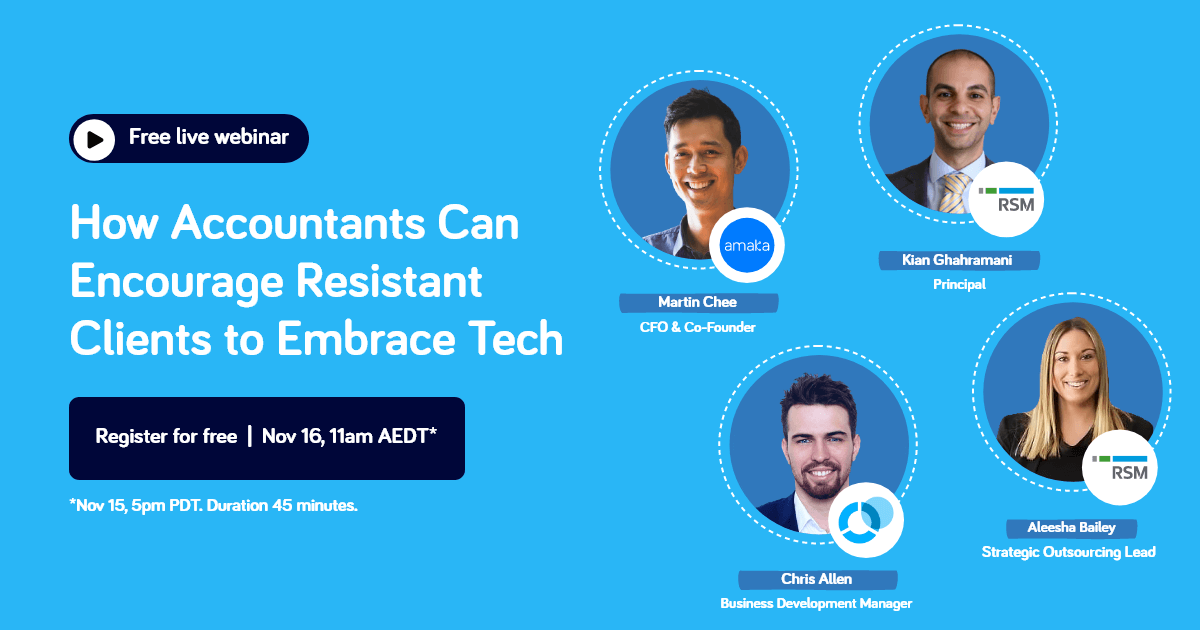

Another key part of change management is how you implement accounting technology with clients. In our webinar on how to encourage resistant clients to embrace technology, we’re teaming up with leaders in the industry from Spotlight Reporting and RSM to explain how top accountants are effectively guiding clients on their digital transformation journeys.

List your practice

Join our directory and showcase your expertise to 1,000’s of merchants.

How accountants can structure pricing: Value-based vs. fixed-fee

Last but definitely not least, the most effective way to increase your margins is to change the way you structure your pricing. Now that you’ve automated and systematised more tasks, you can price based on the outcome and value you provide rather than the time you spend. However, note that there will likely be some cases where it’s easier to charge a fixed hourly rate.

Sidney Cachuela found that it’s common for young accounting firms to race to the bottom with pricing. With his firm, he moved away from traditional hourly rates and instead employed a mixture of value-based and fixed-fee pricing. Not only did it help with profit margins, it provided potential clients more certainty and allowed for more on-the-spot proposal approvals.

In terms of how you actually price your offerings, Rebecca Mihalic brought up the fact that accountants who have been in the industry for a long time tend to know how long certain tasks will take. This can act as a foundation for a profitable pricing strategy. However, certain tasks such as bookkeeping might act as a loss leader to help keep everything in-house.

If your firm is dealing with tasks such as government grants and you’re not sure how long it will take, it’s useful to include clauses in your engagements that allow you to change pricing. You can go back to clients, explain increases in price, get their approval and continue on. However, with tech getting better, you might find that tasks end up taking less time than expected.

Key takeaways on advantages of accounting technology

Knowing what accounting technology you should be using can help you stay competitive as an accountant. From there, you can start to plan the implementation so that you can ensure success. Then, you can adjust your fee structure so that you can really take advantage of your time savings. You can finally start charging based on the value you offer rather than your time.

Make sure to register for our November 2021 webinar with Spotlight Reporting and RSM before spots run out: