How to use Shopify cash on delivery (COD): Setup, accounting guide, and more

Cash on delivery, or COD, is a payment method that allows customers to pay in cash when their order is delivered. While not as common today as online payments, enabling COD in Shopify gives merchants added flexibility and caters to customers who prefer paying cash. Offering a cash on delivery option can attract buyers who may not have credit cards or don’t wish to make an online payment before receiving an order.

For Shopify merchants, supporting COD opens up additional sales opportunities and provides another seamless checkout option for customers. We’ll dive into how Shopify sellers can set up and offer cash on delivery, including steps for proper accounting and integration.

What is cash on delivery in Shopify?

Despite “cash” being in the name, COD simply refers to collecting payment after the goods have been delivered. This can be cash. However, merchants can choose to accept other payment methods for COD as well. For instance, payments can be accepted through a mobile POS system or through a check. An online payment can be considered COD if payment isn’t made until after goods are received.

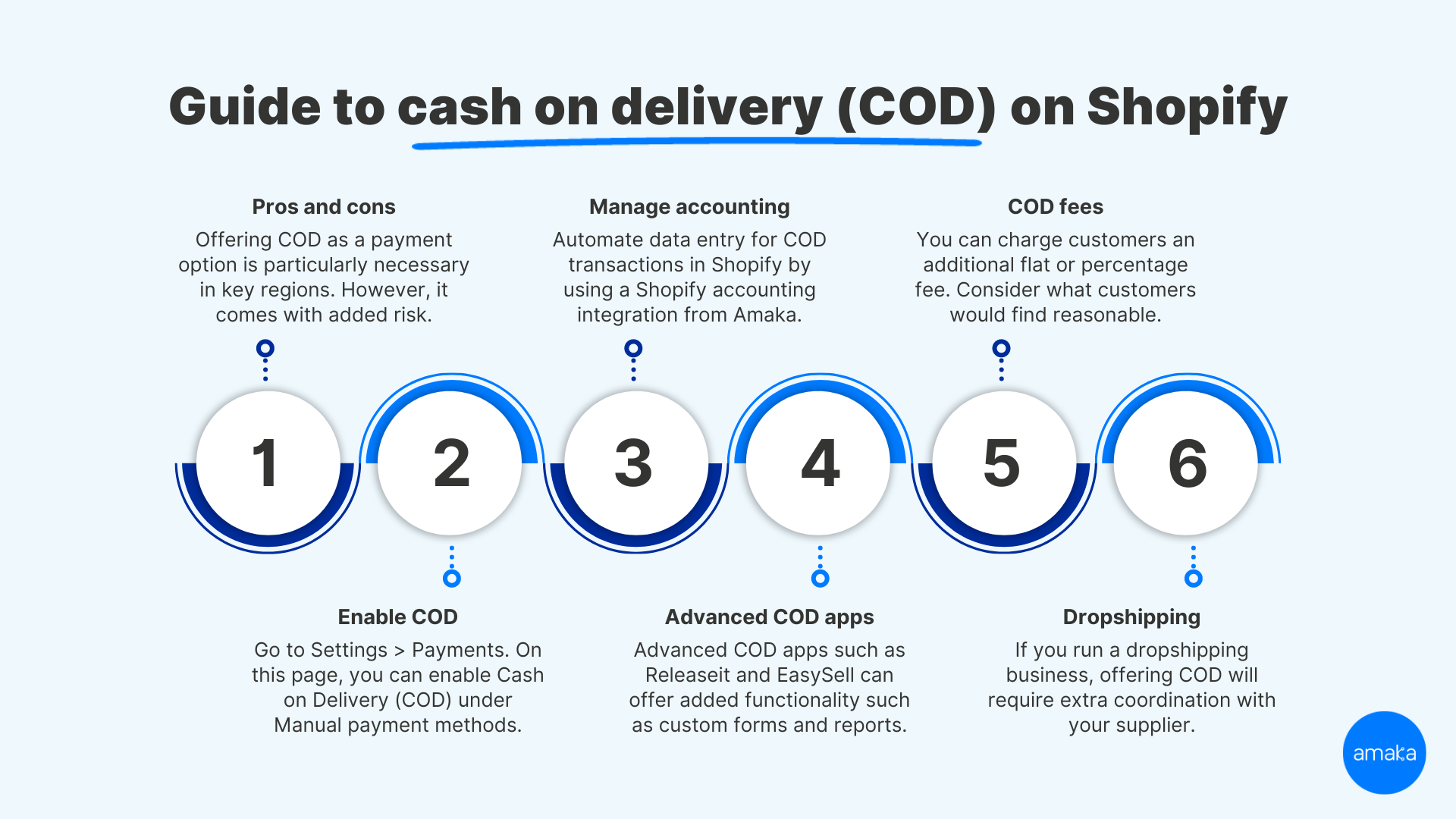

Pros and cons of enabling COD in Shopify

Using COD provides many benefits to Shopify users but there are also some potential drawback to consider before deciding to implement it as a payment option for your business. A pro of enabling COD is that it expands your customer base by opening up purchases from customers who don’t have credit cards or other digital payment methods. It also caters to customers who have a preference to using cash, which can have a direct impact on your conversion rates. Because cash is collected upfront, this eliminates extra processing costs, such as credit card fees.

According to a recent e-commerce report, offering the top three payment methods appropriate to your target market can increase conversions by up to 30%. The top regions making up Shopify stores with a COD app include Colombia (24.8%), Pakistan (11.9%), India (9.5%) and Italy (6.2%).

A drawback of enabling COD in Shopify is an added risk it posses. The cash will be collected by delivery drivers which means there is in increased chance of theft and of loss with this method of payment. There more operational processes involved to ensure your cash handling is secure and accounted for in your business finances which can also cause a delay in cash flow. Because of this, there is also more of a chance of disputes happening if it’s not properly handled. It’s important to weigh the benefits against the potential costs for your business model and available delivery processes.

Enabling cash on delivery in Shopify

Turning on the cash on delivery payment option in Shopify is quick and easy to complete. In your Shopify admin, navigate to Settings > Payments. On this page you will find a setting to enable Cash on Delivery (COD) under Manual payment methods. Simply select the option from the dropdown to activate COD orders.

Shopify allows merchants to optionally set a maximum order value for cash on delivery transactions. For example, you may choose to cap COD at a lower amount for first-time buyers and require online payment above that. Configure this to your preference.

Once enabled and set up, cash on delivery will appear as a payment option for customers during checkout. Be sure to promote COD availability on product pages and elsewhere on your e-commerce site so buyers are aware they can pay with cash upon delivery.

Accounting for Shopify COD orders

Proper accounting for cash on delivery sales is integral for accurate bookkeeping. This is where leveraging an accounting integration is important and provides major benefits. Through Amaka’s Shopify accounting integrations, common manual errors are eliminated because sales data is kept up-to-date between your Shopify store and your accounting software. When a COD order is placed, the order syncs the transaction to a temporary Shopify Cash Clearing account in your accounting software.

This allows you to record the COD sale before cash is collected and keep data up-to-date. Once the cash is deposited, you can compare the bank amount to the temporary COD account total. If they match, allocate that deposit to the Cash Clearing account to zero it out, then post the final cash amount to your business permanent cash account. This workflow enables seamless reconciliation of cash on delivery payments and keeps your books up-to-date.

Schedule a free walkthrough with one of our Integration Specialists to see if one of our free or paid plans could work for your business.

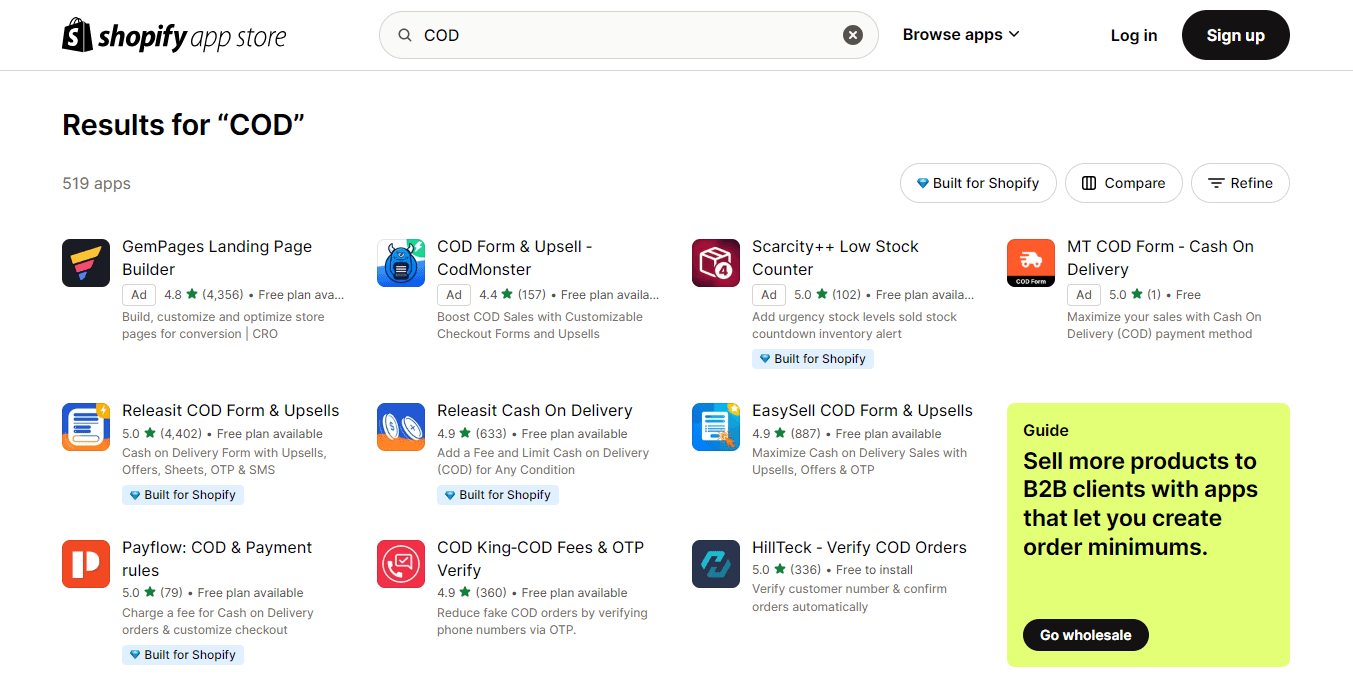

Advanced Shopify app for COD

While Shopify has built-in functionality for cash on delivery, merchants can unlock even more features and automations by integrating an advanced COD app. These apps empower sellers to customize cash on delivery fees with greater flexibility, including options like percentage of order total or partial COD payments.

These apps may even provide helpful reporting and metrics on cash on delivery performance and other key indicators relevant to optimizing a COD program. Advanced COD apps take the hassle out of managing cash payments and provide the tools and insights e-commerce merchants need to maximize the potential of offering cash on delivery. Before implementing COD, research apps that align with your business needs.

Releaseit is a top rated app on the Shopfy app store that simplifies the COD process, and even has features that allow you to customize your own COD order forms. Another app option is EasySell which also has features that makes it easy for customers to check out through filling out a COD form. Both of these apps offer a free version, giving you up to 60 COD order for free along with support options available when needed.

Cash on delivery fees

When enabling cash on delivery in Shopify, merchants have the option to charge a COD fee to customers. Shopify allows setting a flat COD fee or calculating the fee as a percentage of the order total. While fees can help offset the costs of handling cash, providing customer support, and managing the extra workflows associated with COD, merchants should be careful not to set overly high fees. Excessive fees to use COD may deter buyers from choosing that payment method during checkout.

It’s advisable to research what fee structures competitors in your industry are using for COD and what customers view as reasonable. Also be sure COD fees comply with local laws and regulations for your business. Finding the optimal COD fee involves balancing operational costs with providing a seamless and appealing cash payment option.

Using COD with Shopify dropshipping

E-commerce merchants who use a dropshipping model can offer cash on delivery, but it requires additional coordination with suppliers. Because the supplier handles fulfillment and delivery, they must be willing and able to accept cash payments upon customer receipt of orders. This may involve modifying standard processes the supplier has in place.

Extra communication is needed between the merchant, supplier, and customer to ensure COD expectations are clear for all parties. Providing shipment tracking and order status notifications is especially important to keep customers informed since transactions are being handled by an external dropshipper.

While adding some logistical complexity, dropship merchants can make COD work with the right supplier partnership and focus on smooth communications and transparency throughout the cash on delivery process.

Shopify accounting eBook

Learn how to automate your Shopify accounting and spend less than an hour on your books every month.

Key takeaways on Shopify COD

Integrating cash on delivery into your Shopify store can provide benefits for both merchants and customers. Accurate accounting ensures transparency and proper financial reporting. With the right tools and practices, Shopify sellers can implement cash on delivery to drive additional sales, satisfy customer preferences, and manage the logistics and accounting without issues.