Overview

Easily set up your tax mapping and integrate the collected taxes into Sage.

How it works

Answer the two main questions by toggling the button on or off and then, map the tax rates from Square accordingly.

-

If you are collecting sales taxes, set the toggle button on (green).

-

If you are collecting destination-based sales tax, set the toggle button on (green).

-

Specify your tax province if your business is registered in Canada.

What happens to the integration if I collect destination-based sales taxes?

Destination-based sales tax is the tax rate used at the place where the sold item is consumed, not at the origin.

For example, a registered business in Quebec (CA) is registered to collect taxes in Quebec but also registered to collect taxes in Ontario (CA). When goods or services are consumed in Ontario, instead of using the tax rates in Quebec, tax rates in Ontario will be used.

Once you toggle on this button, the integration will automatically create current liability accounts for each sales tax in Square. Note that you can change the mapping to any current liability account.

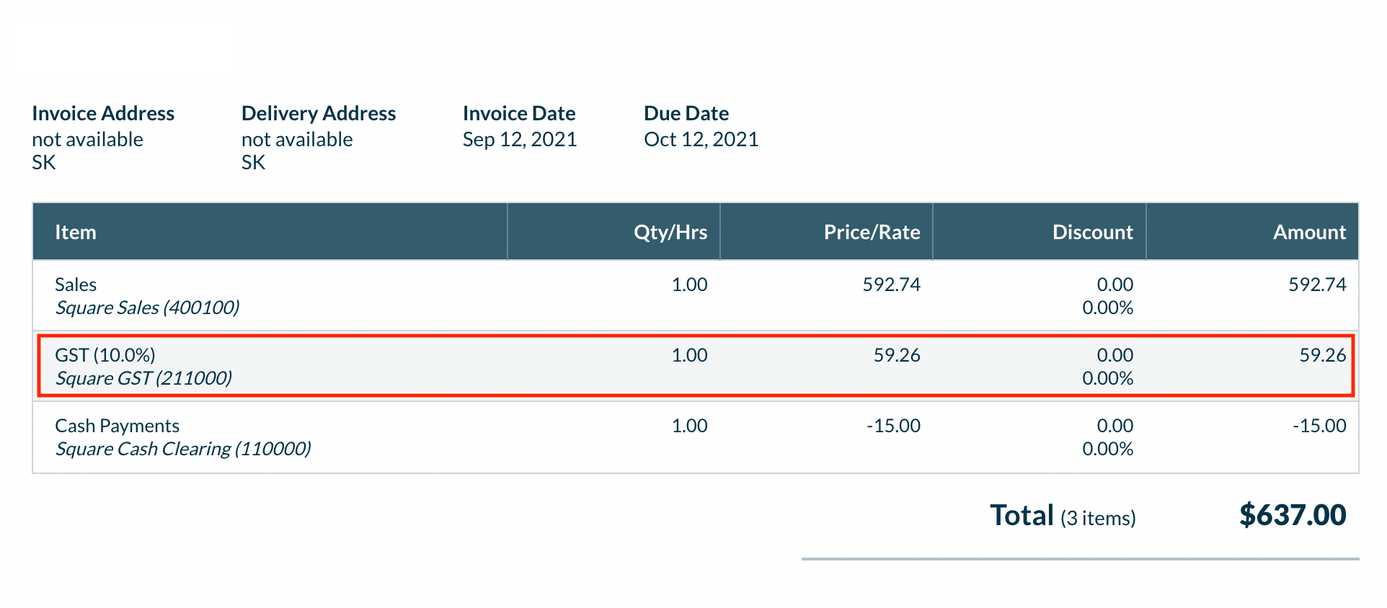

When the integration syncs the tax amount, it will be in a separate line item within the invoice.

Tax province (Canada only)

Specify the tax province where your business is registered. When mapping the tax rates in Square to the tax types in Sage, the integration will only show the tax rates applicable to your region.